Passive Income:

Ideas For Setting Up Multiple Streams of Income

Everyone knows you should have multiple streams of income.

So why do so many people struggle to set them up?

Here’s the truth:

Most people believe only millionaires have the resources to create passive income.

Well, today I’m going to prove them wrong.

Here’s the strategies I’m currently using to earn passive income in 2018.

About the Author

Hey guys, it’s Denis O’Brien.

I’m a Chartered Accountant and have a passion for personal finance.

Katie (my fiancée) and I created Chain of Wealth to teach people how to find money success.

We’ve created content that’s been featured on Rockstar Finance and I was recently a speaker at Fincon in September 2018!

In this guide I’m going to show YOU how to setup passive income streams and help you find financial success!

Contents

Chapter 1:

What is Passive Income?

In this chapter we’ll dive into when income is actually considered passive versus active income.

You’ll also discover why people that tend to accumulate significant wealth, specifically millionaires, tend to focus on this type of income (above all else).

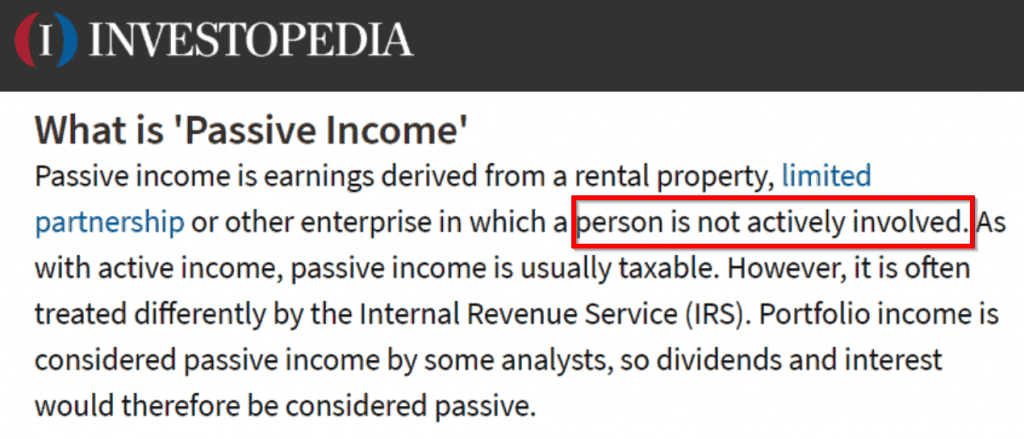

So what is passive income?

Passive income is income regularly derived from sources for which you are not actively involved on a day-to-day basis.

Depending on which country you live in, this type of income is usually considered taxable.

The most important part of the above definition is that you won’t be actively involved.

But sometimes it’s not clear-cut:

Rental income can be considered passive income or active income.

It all depends on your level of involvement.

So in our rental income example:

If you are running a rental business with multiple homes, or running an Airbnb hosting business, that’ll probably be considered active income as it’ll take you many hours each week to run.

Whereas, if you’re renting out your rental property to a family that’ll probably be considered passive as you’re not managing it on a day to day basis.

Fun Fact: Only 20% of millionaires inherited their wealth.

The other 80% are first generation millionaires.

Why Most Millionaires Are Master Side Hustlers

Like I mentioned before, millionaires tend to focus their energy on growing the number of income streams they have, while managing the streams they have already setup.

In fact, once an idea has turned into a passive income stream-

It normally takes very little effort to maintain the revenue stream relative to the time it would take to setup a new one.

When most people picture millionaires this is what they think of-

And while that may be the case for some-

Most millionaires are self-made (more on this later).

So how do most wealthy people make passive income?

They focus on creating multiple sources of income one at a time.

Tomas J. Stanley (who founded Affluent Market Institute), conducted an empirical study of the affluent and he published his findings in one of my favorite personal finance books, The Millionaire Next Door.

Without spilling the beans:

The rich are not who you think they are.

In fact, they are your average families that typically live well below their means and accumulate wealth over a long period of time.

They do not wear fancy clothes or drive expense cars (sorry to burst your bubble).

And while some people do get rich quickly…

…they typically end up blowing their money and end up worse than they were before.

In fact, it’s not uncommon for people that blow their wealth to go into huge amounts of debt and often even negative equity.

So how do you avoid wasting your wealth?

Well, that’s what chapter 2 is all about…

Chapter 2:

How to Create Passive Income With No Money

Some passive income streams that pay well…

And then there are ones that’ll waste your time (and even money).

Being able to cut through the noise and identify which types of passive income are right for you is a critical step.

In this chapter, we’ll go through how to tell the difference.

There’s no such thing as free lunch.

My father always used to tell me that and it’s true to this day.

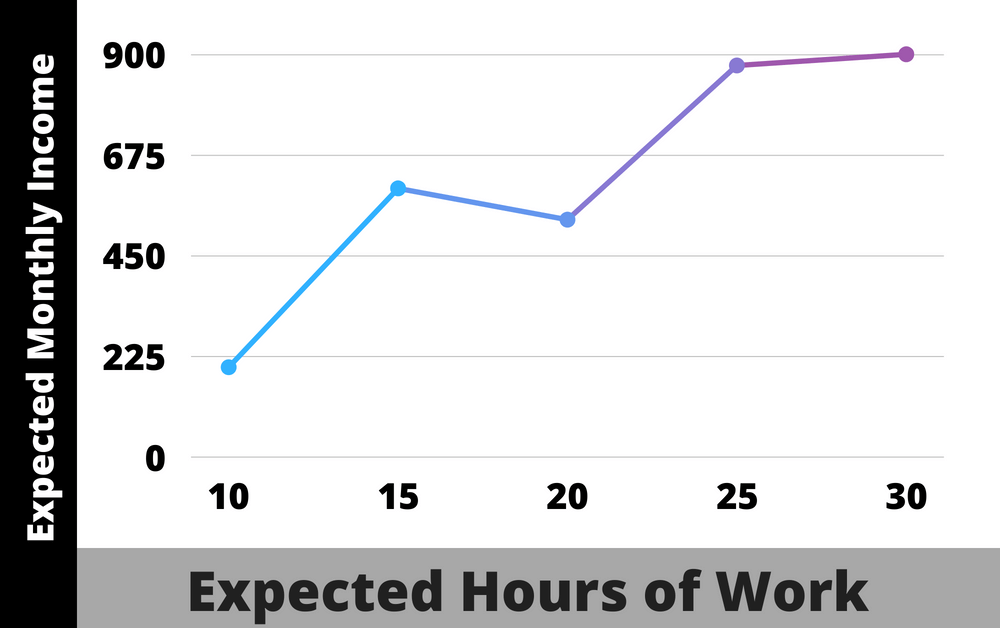

When determining what passive income stream you should pursue, part of your job is assessing which income sources will pay the best relative to their time involvement.

Put in another way:

You need to do a cost-benefit analysis with time as your cost and your potential passive income income as the benefit.

A single income stream yielding an extra $1,000 per month that requires 10 hours upfront and 1 hour per month to maintain may sound great…

But if you’re already working 3 jobs you might be better off giving this one a skip.

As it turns out –

Identifying which revenue streams are better for you is the single most important step when deciding what to invest in.

Below are two steps you can uses to make any income stream passive.

But First: A Quick Recap of the 7 Different Streams of Income

Earlier I said that most millionaires have several streams of income.

Below are the 7 most popular streams of income:

Earned Income

Business / Side Hustle Income

Interest Income

Dividend Income

Rental Income

Capital Gains

Royalty Income

#1: Deciding What to FOCUS on

As you can see, above are some of the basic types of income streams you can put into place to grow your money.

And while this list is not comprehensive-

I would recommend starting with one or two income types from the categories above and build up more as time goes on and as you master them.

- These are income streams and not passive income streams.

- You probably already have some of the income streams in your current portfolio

Another one of my favorite books to read is Think and Grow Rich. 📚

Apart from the book being outstanding-

The title gives away one of the secrets to unlocking wealth.

Your thoughts or ideas are a very powerful and often can be an untapped resource.

The reality of the income streams above is that you need to be creative to learn how to unlock additional income streams.

And while you don’t have to stick to the exact income streams above, it’s in your benefit to go after the low hanging fruit (we’ll get to this shortly).

One of the most important things to master in life is learnings how to FOCUS.

Being able to Follow One Course Until Success is critical to setting up passive income streams or you’ll be running around like a headless chicken.

Some income streams are a lot more passive than others.

As an example, dividend income is a very passive source of income. All you need to do is buy a stock and as long as they declare dividends you’ll get paid every time that happens.

I have friends that have a large focus on dividend EFT investing as a source of passive income and although that sounds complicated it’s really not as hard as it seems.

A more active source of income (at least initially) is entrepreneurship.

You could try to start a business, but that’s a lot more labor intensive.

Below, chapter 3 will deal with more hands-on income streams and chapter 4 will deal with more passive ones.

#2: Converting Income into Passive Income (if applicable)

The fundamental difference between an income stream and a passive income stream is the nature of earning the money more specifically, the time commitment.

It is completely possible to turn an income stream into a passive income stream.

You might think that it is impossible (especially for something like your day job)-

However, once you’ve mastered an income stream, you can always hire someone to do it for you (for less than you earn from it) and focus on other revenue avenues.

I like to refer to this strategy as passive income arbitrage.

In fact you’ll need little to no money to set it up.

Simply outsource tasks that are very repetitive in nature so that you can focus on higher income generating activities.

“Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime.” ~Chinese Proverb

Your primary goal in this step should be to determine which income streams are most important to you in the next 6 to 12 months and FOCUS on automating them as much as possible.

In the next chapter I’m going to teach you how to apply passive income arbitrage to non-passive income streams.

Chapter 3:

The Art of the Side Hustle

I’m going to be honest with you-

Side hustles are the blessing (and curse) of the millennial generation.

But that doesn’t mean that other generations haven’t been reaping the rewards of additional revenue streams for a long time…

If you’re looking for ways to make more money, then this chapter is a MUST.

While there’s a ton of passive income ideas out there, I’m going to go through three different strategies I recommend using.

Side hustles for the most part are not “passive income”, however the virtue of earning more money allows you to create passive income streams and thus learning how to diversify your income is critical.

Idea #1: And the BEST side hustle is.... Just Google It.

In creating this article, I’ve been reading a ton of articles about side hustles.

There are thousands of posts created every week by personal finance bloggers around the topic and quite literally, the format of the writing is often the same:

“The Top [insert number] Side Hustles of [insert year]”

The Rockstar Finance directory is definitely a place you want to check out to find great personal finance content.

My honest thoughts?

Everyone has created a list of well thought out side hustles and although there are similarities between a lot of the articles, there was one common theme across them all.

The top side hustle is:

Erm…

Well, you could always just Google it?

Truth be told it turns out that there is not one “greatest” side hustle.

There are literally thousands of different ways you can make extra money.

Bonus:

One-Two Punch To Easy Income

- Write down a list of all your passions (stuff you enjoy doing outside of work).

- Try to type the following key phrases into Google and find a side hustle that looks great to you.

- [your passion] + ways to make money

- How to make money from + [your passion]

- Top earning jobs for + [your passion]

- inurl:[your passion] jobs

What I would recommend is jumping on any of the excellent resources out there and find a side hustle you are interested in and see if there are ways to make it passive.

Your primary goal in this first step should be to determine which income streams are most important to you in the next 6 to 12 months and FOCUS on automating them as much as possible.

Idea #2: The Laundry Method

Katie recently created a post called the Laundry Method:

To save you the trouble of reading it-

Here’s what makes the Laundry Method amazing:

You get paid for the routine tasks you were going to do anyway.

You should try to monetize anything that you have to do as part of your daily routine.

Such an example is going to work-

Next time you’re sitting in traffic, consider hopping onto a ride sharing app and taking passengers in to work with you.

It might make your commute slightly longer, but you got to work for free, or in some cases you even made money.

Here’s a video explaining the principle-

Idea #3: Freelancing

Most people don’t realize just how lucrative freelancing can be.

In this day and age- freelancing can be as simple as pulling open a laptop and plugging away for a few hours, all from the comfort of your home.

There’s a ton of resources you can use to start freelancing, however the most important thing you need is a marketable skill.

Everyone is good at something.

You’ll probably find that you’re naturally better than most people at something else.

It could be graphic design, woodwork, sales, marketing, any variety of specializations.

Point is you need to be able to take your skill and monetize it.

In most cases, this should require a bit of polishing up on a skillset and finding the right medium to market yourself in.

Where to market yourself?

It’s probably not on some internet chat group-

Speak to people you already know.

The chances are someone needs a very particular skillset. The best thing you can do is network in person.

Chapter 4:

Make Appropriate Investments

As an investment professional, I know many things that the average investor does not know.

Now I’m not going to give you the latest trading tips, but I am going to teach you how to invest responsibly.

First off- everyone should be investing.

Period.

What Your Math Teacher Didn't Teach You In School

It doesn’t take a genius to understand the more money you save the more you’ll have in the future.

But just how much of a difference does it really make?

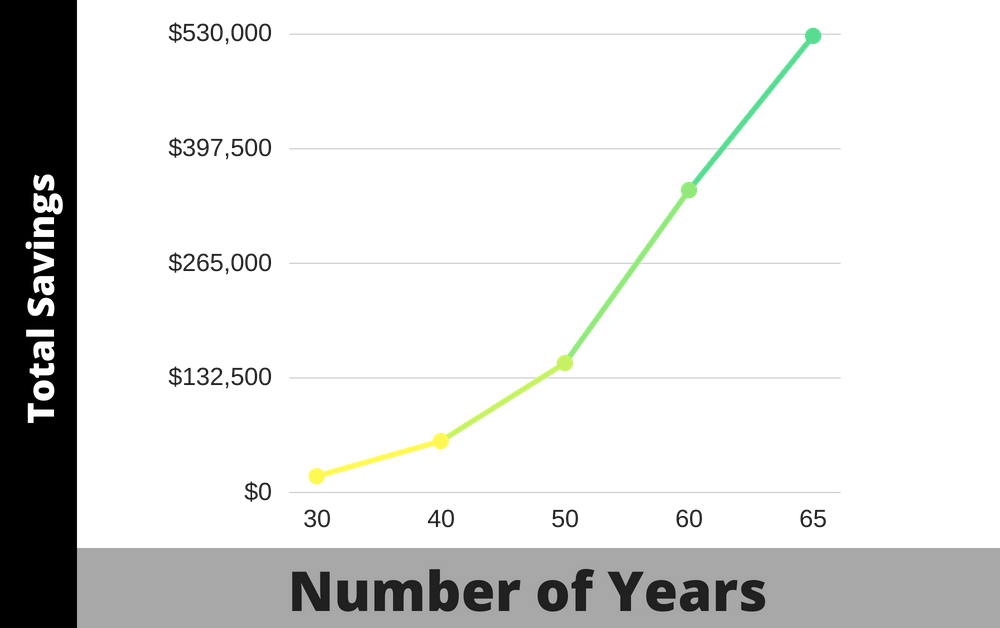

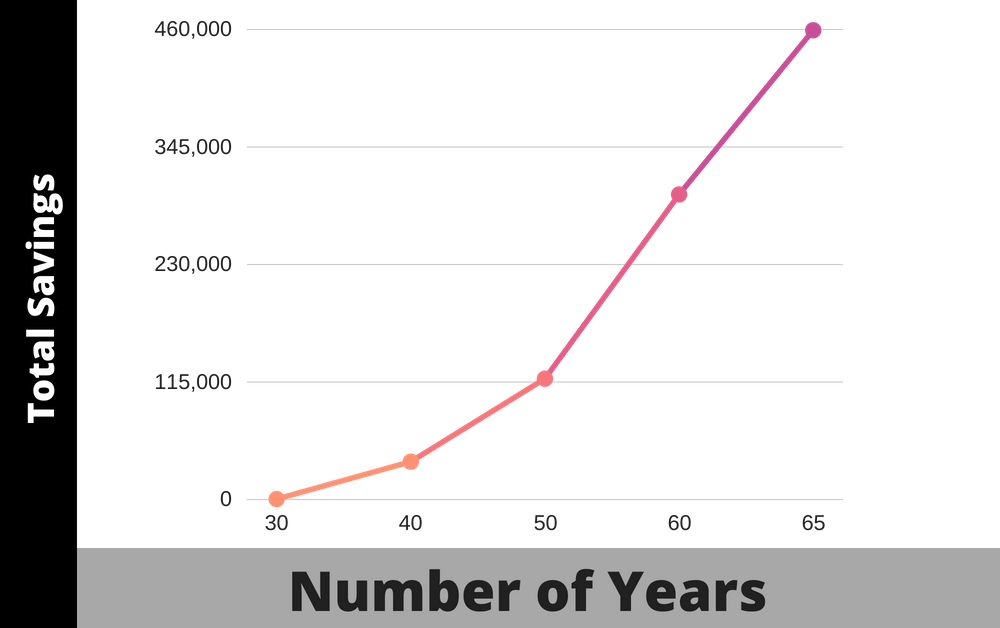

The graphs below demonstrates the difference between investing as follows:

- Jill invests $100 per month from 20 years old.

- John invests $200 per month from 30 years old.

In both scenarios, let’s assume that both Jill and John stop working at 65 years old and they never increase their investments.

Jill & John both invest in the S&P 500 and enjoy an average compounding of 8% per annum.

Now, I’m sure you’ll be quick to say-

“Well if Jill invests for 10 years longer of course she’ll have more money.”

But that’s not what I’m demonstrating here.

Consider the following-

Jill invested as follows: $100 * 12(months) * 45 (years) = $54,000.

While John invested as follows: $200 * 12 (months) * 35 (years) = $84,000.

Now, at retirement age (65 years old):

- Jill saved up $530,000 while only contributing $54,000 (981.4% return)

- John saved up $460,000 while contributing $84,000 (547.6% return)

This brings me to my first principle-

You need to start investing as early as you can. Even if it’s smaller dollar amounts.

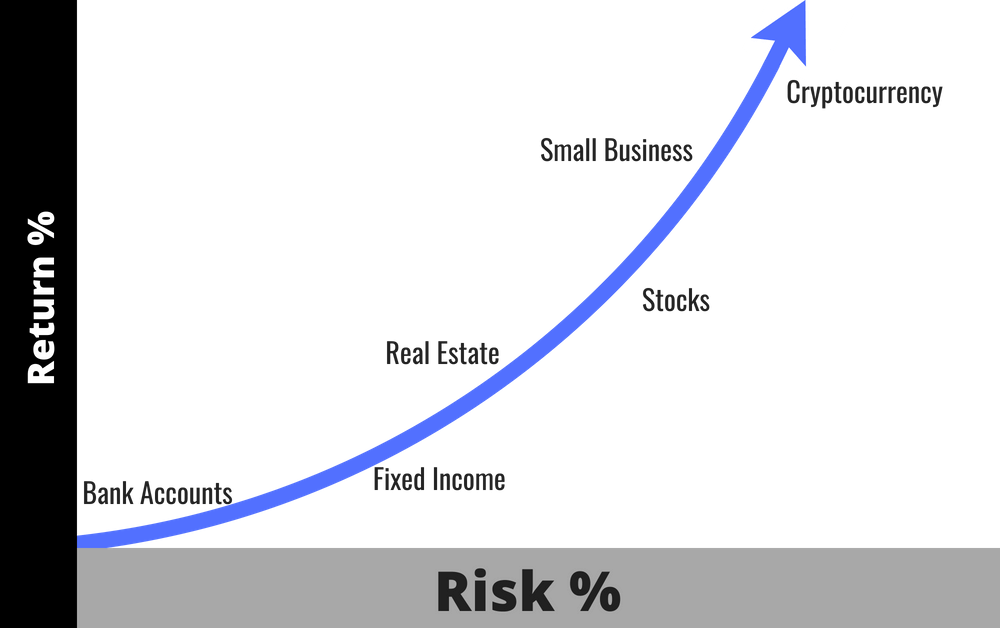

Why Asset Allocation is Extremely Important

A common mistake many inexperienced investors make is they assume that we all have the same investing needs.

Some people will need to draw income off their investments and therefore cannot afford to take on as much risk with their money, while others will draw no income and can take on additional risk.

This is called the risk appetite of the investor.

This should be an integral part of constructing a well diversified and balanced portfolio.

Another thing that needs to be added into the equation is your age.

Sure, age is just a number (or so I keep telling myself that)-

But you should shift your asset allocation to lower risk assets as you get older.

This is actually something that your fund manager should do for you.

However, if you’re more hands on investor you should be doing this yourself gradually.

Ultimately when it comes down to investing-

The worst thing you can do is not invest.

What About Passive Income Through Real Estate?

Ah real estate.

Probably one of the best examples of passive income is a real estate portfolio.

Once you’ve learned how to invest in real estate, you’ll own a bunch of houses and make money from renters each month.

Although there can be maintenance work on the houses, if you’ve bought in a good area the rent you’ll receive will cover the mortgage, maintenance and even pay you for your time.

I’d high recommend adding real estate to your portfolio because for the most part, it’s a very stable asset class.

Chapter 5:

Track Your Progress

Every personal finance blogger worth their salt will push you to start budgeting.

The B word is something most people know they should do, but most people don’t.

And yet in this day and age, it’s super simple to track your spending and now you have a new found category – Passive Income!

Everyone hates the concept of a budget.

But it’s probably one of the most effective ways to become wealthy.

Why?

Because it’s directly linked to goal setting (I’ll explain why below).

Why You REALLY Need a Budget

I’m not going to lie to you-

I only really got serious about budgeting in the last 6 months.

Now I’m a finance guy by profession-

But that didn’t stop me from making all the excuses in the book as to why I didn’t need to budget.

Looking back I feel sick at how much money I wasted and didn’t realize I was leaving on the table.

If you’re in this boat, don’t feel bad.

According to this study by the USBank, only 41% of Americans are actually budgeting.

Budgeting is a crucial skillset that should be taught in school from a young age. If you don’t budget already you need to start as soon as possible.

I mentioned above that it’s similar to goal setting.

Well, did you know that by simply writing down your goals and regularly reviewing them with other people you’re exponentially more likely to achieve them?

You might say ok great, but I’m here to get rich by creating multiple income streams, not to run through a quick self-help crash course.

And I get that.

But given above, I’m sure you’ll agree that you definitely should have clearly defined goals.

Remember- this is a long term strategy, you need to be looking towards the future.

The more specific you can make your goals the better.

Katie recently created a free budget template which you can download from that link.

But there are also loads of apps you can use as well such as Mint, You Need a Budget and Personal Capital which link to your bank accounts.

Be Accountable and Honest With Yourself.

I mentioned in Chapter 3 that you can turn almost anything into passive income.

But here comes the kicker:

You need to be honest with yourself and determine if what you’re doing is getting the results you’re looking for.

Are you investing too much time into generating a passive income stream than what it’s worth or is your time better spent elsewhere?

Ultimately, this boils down to you and there is no hard and fast rule as everyone is in a different financial position.

If you decide something is taking up too much time, stop it and do it quickly.

You need to be able to react fast when you realize something isn’t worth it, that way you can spend your time on other activities.

Chapter 6:

Bonus Tips, Strategies and Real Life Examples

There’s a ton of stuff to learn when it comes to passive income.

And nothing explains things better than an example.

These are my tried and true passive income strategies that can help you earn more money.

How To Create Passive Income

One of the most important money lessons you can learn is that money is a long term thing.

Whether you’re trying to pay off debt, save for a down payment or build up your credit, you need to start as soon as you can to achieve your goal.

The reason for this is COMPOUNDING!

"Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it. Compound interest is the most powerful force in the universe."

Albert Einstein Tweet

Don’t get left behind by putting off money decisions.

Side Hustling Can Make a Massive Difference

Although side hustling is NOT passive income, it can directly lead to increased passive income streams by having more disposable income available to you.

Becoming a master side hustler can take a ton of time and planning.

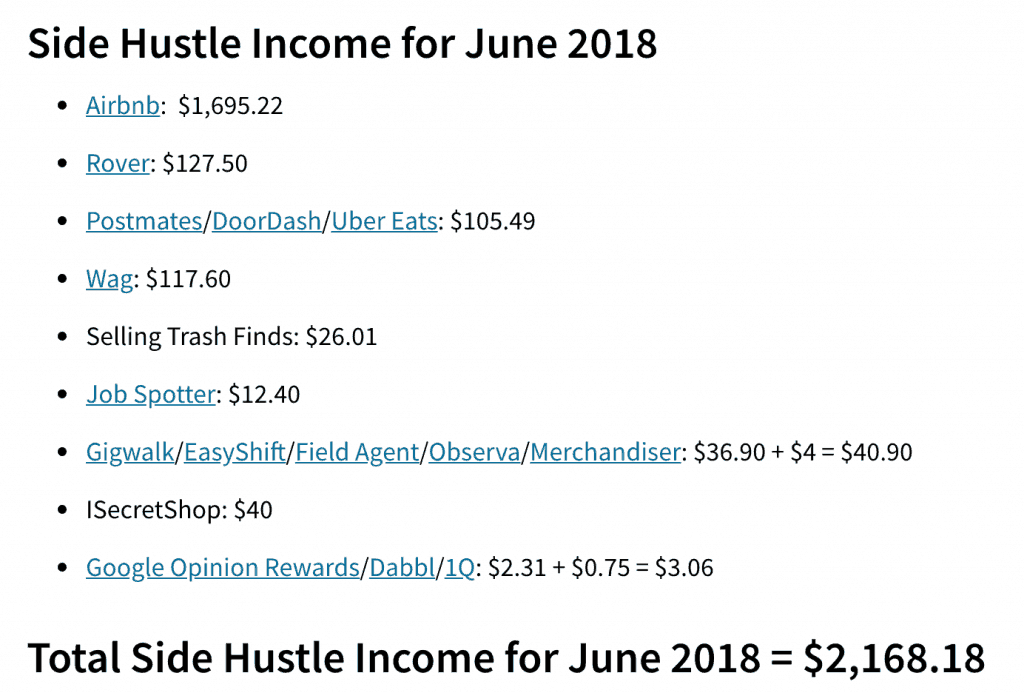

One of my blogger friends, Kevin from Financial Panther is a master side hustler.

Here’s one of his most recent side hustles reports for June 2018-

Sure, $2k is not enough to live off, however that’s over and above his standard income (as a lawyer), and if he’s earning that every month he’s boosting his annual income by over $25,000!

Creating Passive Income Online

I have two friends who are crushing when it comes to generating passive income.

Blogging is a way to make passive income and I have a ton of friends in the personal finance space that are making some serious side money.

First off is Pete McPherson who teaches people how to blog. If you’re not sure what blogging is, you should check out his post on how to start a blog.

You might be thinking, that’s great but how is he making money? Pete created an online course where he teaches people how to blog. He put in a lot of work getting the course up and running but it’s evergreen so it’ll never get old.

Michelle Schroeder-Gardner is another great example of someone who makes a ton of passive income online through her website.

She also actually created an online course which details how she makes over $100,000 a month.

We recently reviewed the course which is called making sense of affiliate marketing.

In short she makes money off her website when someone clicks on a link and completes an “action”.

Michelle took the time to set this up but she is now making a ton of passive income from it.

Genius!

The Final Lesson

The formula below is of the upmost importance for your income earning potential.

You only have a limited amount of hours in your lifetime.

Money = Rate x Hours

Why don’t you try to negotiate a raise at work or with your next client?

Even if you get 5% or 10% more money, you’ll be substantially better off than what you were before (and you’ll probably be doing the exact same work).

Pretty simple, huh?

Now It's Your Turn

Did you learn anything new or have any take aways from this passive income guide?

Or maybe you have a question.

Either way, leave a comment below right now.

44 Responses

I loved this ENTIRE lesson…thank you!

Thanks so much Jeanne!

Looks great dude! Super informative. I’m a huge fan of Brian Dean (BackLinko) and your post format looks amazing like his (total complement and I’m super jealous cause I’m terrible at that stuff).

Thanks Ben!

I’m actually in Brian’s course 🙂 His content is EPIC, I’m trying to catch up 😛

I side hustled to full-time, and now I’m working on the whole “passive” side of things. Working on a business model that scales better and saving up for my first real estate investment!

Hey Eric,

That’s super awesome- I’m glad you’re working on that real estate income stream! Looking forward to seeing some pictures 🙂

I’ll see you at Fincon!

Creative way to explain one of the hottest topics that commonly comes up in almost every discussion about how to build and maintain wealth! I love the simplicity of it–nice job Dennis!

Thank you Mary! I really appreciate your feedback 🙂

This was so comprehensive and great! Wonderful info!

Thanks Melanie!

Awesome post man, very well done! Informative and looks great, I’m sure it will help a lot of people.

Thanks so much Matt! I really appreciate your kind words 🙂

Wow you put a ton of time and effort putting this together!

Royalties are definitely a more advanced level of passive income that takes establishing a brand first. Most people will probably not get to this level due to the time and commitment involved. Pretty much full time self employment to start but the dividends can be enormous.

For example after Obama became President he wrote books about his his role and autobiographies and they have grossed enormously just from royalties which he reinvests back into treasuries. That’s money making money.

Although he was well educated he was only middle class before he was President and now of course today after leaving office he’s more rock star celebrity status. He’s even got the socialite glow.

Looking forward to hear your presentation!

Royalties definitely are a more advanced topic. I love your example and I think very often it is about building that brand.

I’m going to be adding in some more examples into the last chapter to give people some additional ideas.

Thanks for your feedback!

Denis, this is awesome. I love the content itself and the presentation and images are outstanding. Great job!

Thanks Mike, I really appreciate it!!

I think the holy grail of financial freedom is having so many passive income. This way you will never worry about your financial needs because everything is taken care of your assets. You will have all the your time in the world and visit all places you dream about. You have your time and money. This is the dream of most people which only few ever achieved.

Hey Kaye,

I couldn’t agree more. Income producing assets are critical to generating substantial wealth.

Thanks for stopping by!

Hi, can you recommend an app to track multiple side hustles?

Hey Heath,

I don’t have any particular app I use, but excel is great for tracking which ones pay the best.

Good luck!

This is great! I’ve been watching some of the Midwestern markets for buying opportunities. I live in Denver and prices are pretty high, along with very low inventory right now. It’s hard to justify the big price tags here. Onward!

Jon- it is hard to justify the big price tags, but if you start dollar cost averaging your investments then you’ll never feel salty about high prices. 🙂 Doing so helps you get a more realistic average cost, especially over a longer time horizon. Always be buying. Good luck!

Ben, you just made my day! I woke up confused about my finances, only to fortunately stumble on your site!

It has really blessed me. I learnt so much in a short while.

I’m presently working on setting up a passive income strategy for me and my friends, and this article has really opened my eyes. Thanks so much.

Hey Suleiman, glad to hear our post gave you some clarity! Let me know if you have any questions 😉

Great start to go to when making the decision to start working smarter and not harder. As a baby boomer I wish this kind of

information was available some years age. I’m currently ready to get off the treadmill and do some passive income work right from my own laptop. These strategies have given me a sense of directions to go into, from setting goals, to investing, and now work on affiliate marking for passive income.

Thanks for this wonderful insight for baby boomers who want more out of life. Looking forward to getting started.

I wish you all the best Kathleen!

Good luck!

This post is really helpful for me I just started new my own blog here is first post of it : 10 Amazing Smartphones Hacks Which Can Save Your LIFE – https://www.tenreason.com/?p=999956483

Hey Sutro,

I’m glad you found it helpful, all the best with your new blog!

Hey Denis,

I like the way you wrote this post. This is really worth reading for the one who really want to generate passive income. I have also written some good points on passive income. You can check mine. Anyways, Good Job! Keep sharing such good content.

I will come again to read more articles. Thanks.

Hey Ezaz,

Thanks for reading.

I checked out your post and you really do have some great ideas on there!

Hi Expert,

I will read your post on the way of making passive income. I like this post. specially Blog Based Passive Income. I also have a blog where I will post a similar post like this https://www.financialiqtoday.com/35-way-to-make-extra-income-passive-income/. It’s not probably like you But I will try it.

Thank you,

For giving me this post.

Hey Navraj,

Awesome! I find blogging probably one of the tougher passive income streams to set up but it’s definitely possible, I’ve some friends making tons of cash with their blogs.

Best of luck with your blog!

It’s been a while since I found refreshing content like this. Takes me back to 2004 – when I first read Rich Dad Poor Dad by Robert Kiyosaki. That lead me down the self employed and business owner route. Still getting that together. Never really looked into investing after that. I look forward to more simple investing options.

Thanks! We’ll be sure not to disappoint. 🙂

Hello,

Thanks for all the information you have provided over here.

It is informative and that too in so much depth.

Keep up the good work

By the way, we have also created some contents regarding Passive Income, you may find it interesting also, you may check it over here – How to Make Passive Income

Thanks for stopping by, I’ll check it out!

You must have multiple income streams as an entrepreneur! If one if your income streams collapses then you will always have other ones to fall back on while you are rebuilding!

Great article!

Hassam, I totally agree the more the better!

Thanks for sharing, keep doing good work.

Thanks Priyanshu!

It’s great that you explained that when a person receives a regular income from a source that they do not interact with every day is known as passive income. This type of income, if used and understood properly, can earn someone a lot of money with little to no effort done over time. Thank you for teaching me and other people about passive income.

You’re welcome David!

your artical is very helpful. thank you so much and keep going all the best.

Thanks Anshul.