How to save [at least] $400 a month by tracking your spending

If you are finding that you are broke:

- at the end [maybe even the middle] of the month and are counting the hours until payday

- paying off debt

- can’t save any money

Then one thing is for sure: you NEED to track your spending!

I was all of these scenarios above.

As a teacher, I would get paid and have money for what felt like a second and then before I knew it, I was right back to being poor.

The worst part was that I never considered myself a big spender yet I was always broke.

Although I didn’t frequent the mall on a regular basis, I did make one pretty foolish big purchase where I ended up with a ton of negative equity that sucked up a large portion of my take home pay.

Eventually it got to the point that one time I checked my bank account and only saw purchases from Starbucks, Dunkin Donuts, Dollar General and Taco Bell.

I felt ashamed [and bloated] seeing that in a few days I had spent about $75 on things I didn’t really need or added that much value to my life.

It was an exhausting way to live.

Finally, I decided it was time for a change. I didn’t want to look at my tiny bank account littered with fast food restaurants anymore.

It was time to make a budget.

WHY A BUDGET IS NECESSARY

As an “adult”, you hear the word “budget” tossed around rather frequently.

But, what does that actually mean?

I knew I should be budgeting but truth be told, I didn’t actually know how to begin.

To me, I always thought of someone with a finance or accounting degree crunching numbers and muttering phrases such as:

“I can’t afford it” or “no, it costs too much, put it back”.

Like most others stereotypes, this is false

Through the years, budgets have gotten a bad rap.

It doesn’t have to be all save and no play.

As millennials turn from college students to young adults a few things are for sure-

We:

1. have a smartphone or other technology that require monthly payments

2. will [most likely] have student loan debt

3. aren’t promised Social Security when older

4. Probably not properly investing

These four things are major differences from past generations.

There wasn’t the social media sense of “keeping up with the Jones’” that has made everyday life more expensive and stressful for people who are just starting out.

With all of these “extras” that we can enjoy, comes an added sense of responsibility that needs to be considered.

For some millennials, they have more student loan debt than credit card debt.

That’s great and terrible at the same time.

We are educated in our careers of choice, now we need to be educated in our finances- even though we never learned in school.

We need to budget- so we can pay off these loans and eventually retire all while enjoying life.

HOW TO START

This is the what most people think of as the scary part.

Truthfully, it isn’t scary and not that much is going to change.

Only now, instead of willy-nilly spending your money and going through life as a tornado, you are creating a plan for your money.

Another myth busted: A budget does not mean you can’t have any fun.

In fact, it’s the exact opposite.

Now, you will be able to afford to have fun without the guilt/ fear of checking your credit card statement later.

*Tired of reading? You can listen to me and Denis talk about how we are tracking our spending. Just click the link below. 🙂

You need to budget “fun” into your life.

If you have gone most of your life spending money however you like and not keeping track of it, this could be a bit overwhelming at first- but after a week or so it won’t be bad.

Here is a step- by- step guide that I did:

(I like to keep mine organized in an excel spreadsheet but you can also download Personal Capital to make it a bit easier)

- Write down ALL of your bills & how much they are

- Check how much you bring in a month after taxes

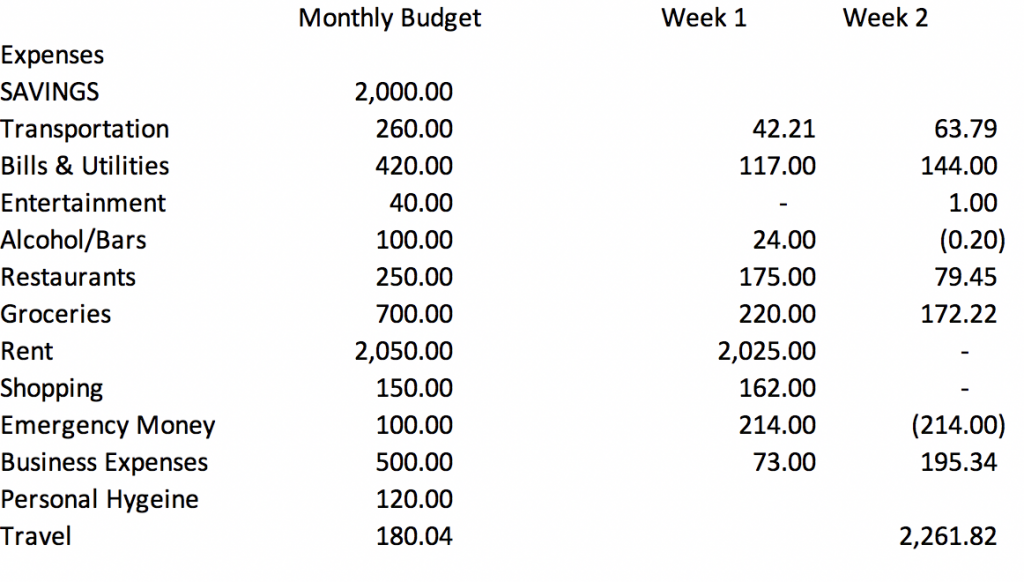

- Create separate categories – Mine is below. Once you have all of your categories and amounts set, you can adjust how much you want to set for each category.

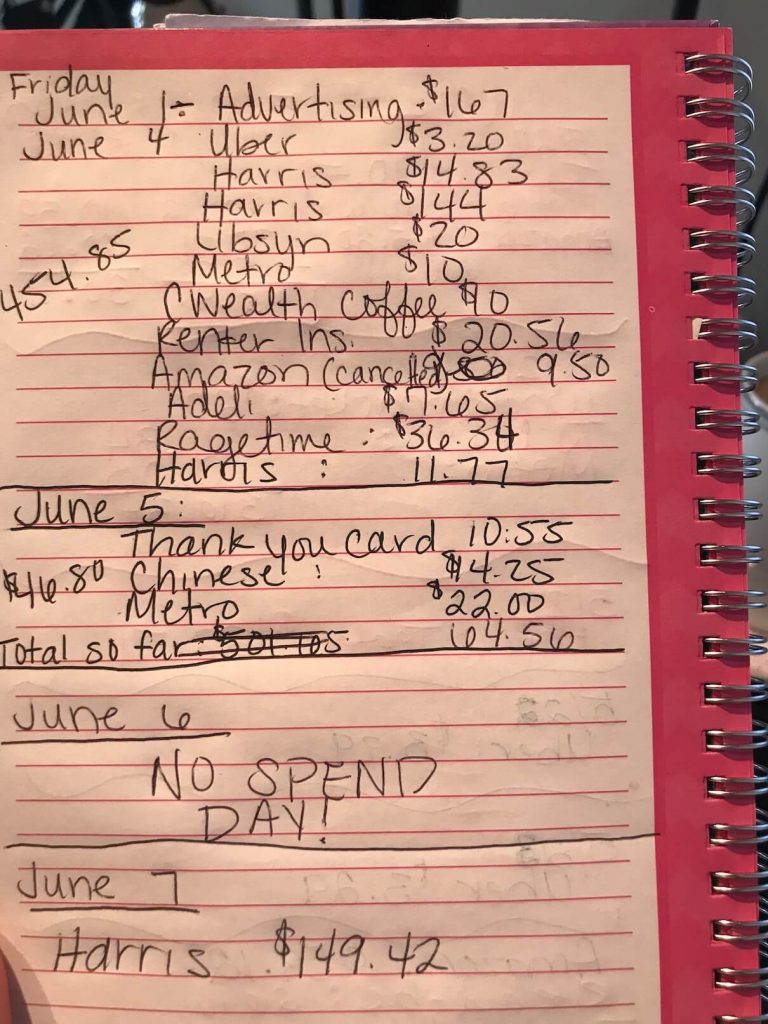

- Write all your transactions down- This step is crucial for me.

- Review your budget weekly.

*This has tremendously helped me cut back because now I realize how much money I have allotted for each part of my budget. Meaning that if it doesn’t really add value to my life, I’m going to give it a skip.

We like to monitor it weekly for a few reasons:

- It lets us see what we spent for the week

- We see how we look for the upcoming week- do we need to cut back somewhere?

- It is a really quick process if you do it regularly

- It motivates us to keep on our frugal path to reach our goals

This is what my journal looks like- When I go out I keep receipts and update it quickly when I get home.

THE BENEFITS

So why should you track your spending and create your budget?

I have heard for months about how important it is to track your spending, but I didn’t put it into practice until having read books such as, “Your Money Or Your Life”

I listened to it on Audible (click here for a 30 day free trial)

Experts say that a person is exponentially more likely to achieve wealth if they track their spending and net worth.

I would say that the best part about tracking my money is that now there are no more surprises- such as late fees or overdrafts.

I always know how much is in my account and this has allowed me to start saving money for retirement and boost up my debt pay back plan.

WHAT IF I HAVE MORE MONTH THAN MONEY?

What if you are tracking all of your spending and you in fact, have more bills than money?

This is a problem for obvious reasons- but that’s okay.

With a plan, it can be fixed.

If you have more expenses than money coming in, you have two options:

Cut back

Make more money

Ways to cut back

- Cook instead of going out

- Cancel cable

- Read or listen to podcasts

- Cancel all subscriptions. (until I started tracking my spending, I didn’t realize how much money I wasted each month on subscriptions)

- Walk or ride your bike

- Be a one car family

Make more money

- Start a side hustle- I made about $500 in a few days by figuring out how to get paid by doing what I usually did anyway- it was the best and easiest money I’ve ever made.

- Negotiate a raise

HOW AM I DOING NOW?

I have implemented tracking my spending into my life- now I do it everyday.

I can wholeheartedly say that I am doing better now than I ever have.

It is an empowering feeling to be in charge of your money instead of your money being in charge of you.

I wish that I would have started this exercise years ago- who knows how much money I would have saved/ debt paid off by now.

I have also started using a few other apps besides personal capital to help keep me on track with saving goals.

My two favorites are:

Digit.com : It links to your bank account and it automatically takes sums of money out of your account.

I forgot about it (when I wasn’t tracking my spending) and when I checked I had an extra $100!

If you sign up and need to take a break, you can go in and pause your saving in 3 month intervals.

This is a great way to save for a future trip.

For example: I have a bachelorette party to go to in a few months. Between credit card gaming and the money I save in Digit- I don’t really plan on saving anything extra for the flight and trip.

StashInvest: is a super easy app that you can schedule the same amount to come out of your account at a set time.

They also offer education on their platform.

Basically, it’s cheap education and an extra built in interest bearing savings account for $1 a month.

The best part?

All of these apps can be easily managed right on that smartphone that you’re having to make payments on- oh the irony!

A QUICK WRAP UP

So what do you think? Is this this something that you are thinking about trying?

In the comments section below, I want you to answer 3 easy questions:

1. What is holding you back from tracking your spending?

2. How do you think it will improve your life?

3. What is ONE of your financial goals?