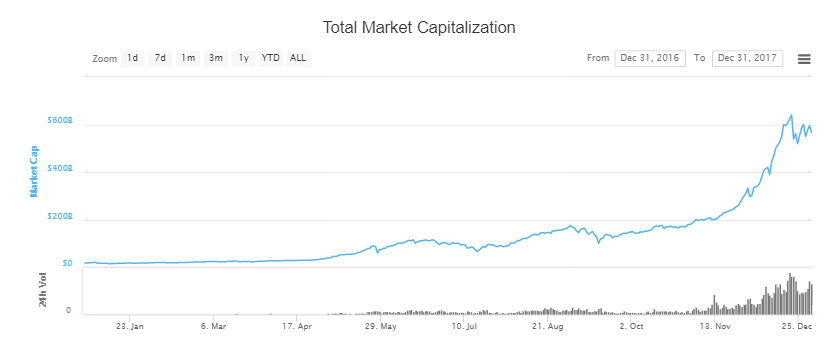

Cryptocurrencies were a hot topic in 2017. By one measure, the total value of this industry increased from less than $20bn to $565bn.

This growing asset class has attracted many people purely because it’s been going up, who doesn’t like a 2,700% return on investment?

We can reasonably expect that there was also a high correlation between people becoming more interested in this space and brains overheating. One certainty is that this topic is complex.

When you put confusion and highly charged emotions together, you generally end up with a mess of (mis)information.

It can be difficult to split what is real, possible and reasonable from what is pure hype. We’ll be trying to provide a simple, understandable and unbiased summary of what cryptoassets are all about, with a specific focus on cryptocurrency.

First off, if you’d like to start investing in crypto, create an account with Coinbase first (this link will give you $10 of free Bitcoin if you fund more than $100 in any of the Cryptocurrencies on the app), you can do it now quickly while I wait.

Wait, cryptoassets? But everyone is talking about cryptocurrencies?

- Currencies – a form of money which is useful to transact and/or store value. (Bitcoin, Bitcoin Cash, Monero are a few examples)

- Commodities – tokens that are used like raw material for building things. Popular ideas include cloud storage, sharing computing power and very cheap cell data

- Products –tokens that represent some finished goods. The best example right now? You can buy digital cats that cannot be copied (I’m not joking)

Cryptocurrencies are the oldest form of cryptoasset, have the most development time behind them and have the simplest use case, to work as a store of value and/or a method of payment. Understanding cryptocurrencies is a good place to start.

Why are people so excited about this thing that most of us don’t understand and to be honest aren’t really interested in using right now?

Cryptoassets are based on a few key ideas. I generally find that It can be useful to review whether these ideas are interesting to you before venturing further down the rabbit hole. They include:

- Ownership – you as an individual should have power over your own data and should have the right to be treated fairly in a democratic world

- Globalisation – the world is getting more interconnected and this is a good thing overall

- Openness – we should all be able to see the decisions that are being made about things that impact us directly

When I originally thought about cryptoassets, a few realisations struck me:

- I don’t really have ownership over much of my own data, Facebook controls my social media data and Google knows a lot about my location and interests

- The world is getting smaller, but it’s still super expensive to take money with me when I travel around

- The way governments and banks control money supply and our ability to use our wealth is not open nor is it transparent, even to those of us who claim to understand finance and economics

The overarching theme for people who are interested in cryptoassets is that power has become concentrated.

Big corporations and governments have a lot of control over us and they don’t always act in our best interests. The idea is to develop technology that can even the playing field by removing central authorities.

Why do cryptocurrencies matter?

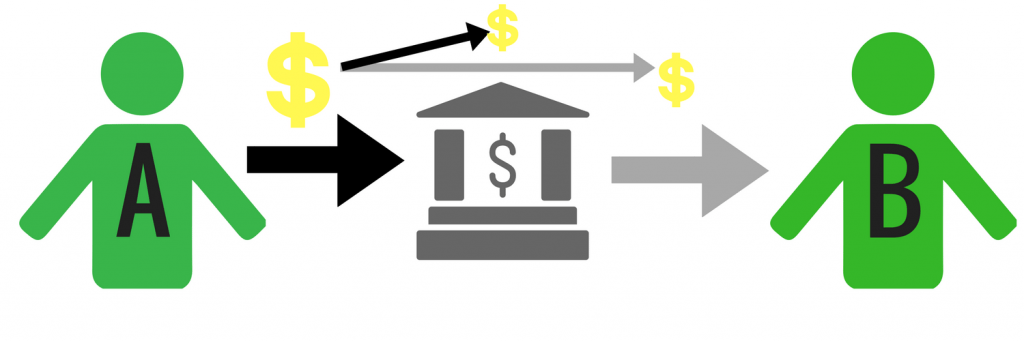

Let’s use an example to illustrate why cryptocurrencies like Bitcoin are important.

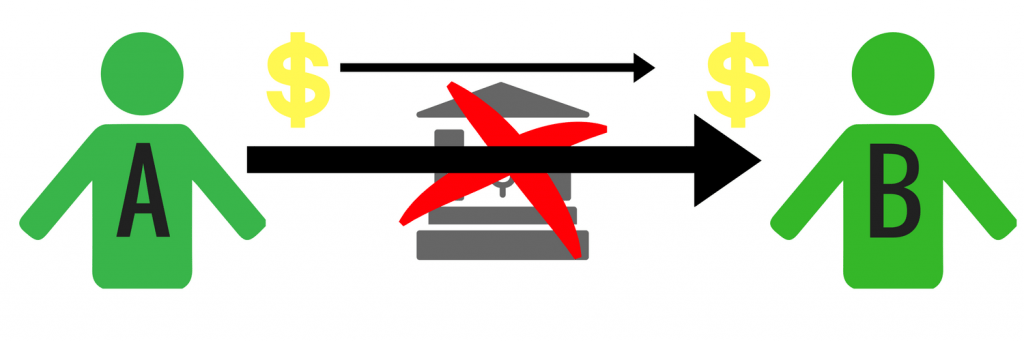

If Andrea wants to send some money to Brooke, the bank makes sure that this transfer happens.

We tend to accept that this is a good system, but there are a few problems here:

- Trusted third parties aren’t always trustworthy – they can act badly

- Trusted third parties are security holes – a single point of control = a single point of {remove: “potential”} failure (i.e. hacking, downtime, data corruption)

- Trusted third parties seek rent – they charge fees at their discretion to provide the service of validating transactions

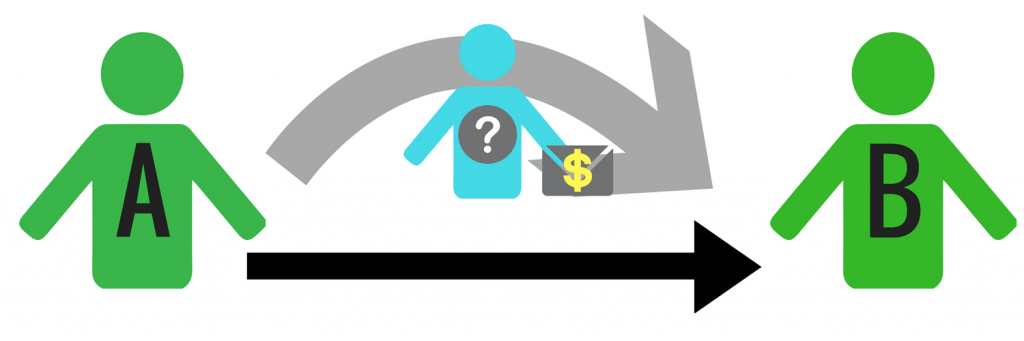

Cryptocurrency has been designed to tackle the problem: how does Andrea send money to Brooke without the use of the bank?

The initial experiment is for Andrea to put money in an envelope and send that envelope to Brooke in the mail.

What we might learn from this experiment is that there are a few practical difficulties for both Andrea and Brooke when they transact this way:

- Speed. It might take a long time for the money to arrive at Bill

- Security. The envelope might be intercepted and the money stolen

- Incentives. One of the actors in this story might act badly to benefit themselves, i.e. Andreas might not send the money and say he did or Bill will receive the money and say he didn’t

How can we tackle these problems?

- We could use a mail delivery medium that is faster than the post. Today, money can be converted from a physical piece of paper into data and the internet is the fastest network we have – use the internet.

- We could lock up the “envelope” so that only Andrea has the key to lock it and only Brooke has the key to open it. This is where cryptography comes in useful and quite literally puts a lock on the transaction that only Andrea can lock and only Brooke can unlock.

- This problem is most difficult, incentivising people to behave the way they should is a tricky exercise.

Believing that it isn’t possible to incentivize Andrea and Brooke to act appropriately takes us back to needing a third party to validate transactions. What cryptocurrencies do is they remove banks which have a lot of power in our existing system and replace the banks with a network of validators, in which no one validator has more power than another validator. We call these people miners.

What are the implications?

- If one validator tries to act badly (e.g. validating a false transaction) there is at least one other validator who can call bullshit

- Most validators will always call bullshit on bad validators because it is in everyone’s best interest to ensure that transactions are valid

- If one validator disappears, there are still a group of other validators that can continue to do their work, so no more central point of failure

Are the incentives really that strong?

You may ask why it is in everyone’s best interest to ensure transactions are valid.

If I (as a validator) try to steal the money in a transaction by validating that Andrea sent money to me instead of Brooke the network picks this up very quickly and the entire system falls down because no one wants to use a corrupt system anymore.

I would pretty much be trying to steal one cookie out of the jar and smashing the whole jar in the process, plus I don’t get to keep the cookie either…

Some of the most important results of this technology are the following:

- I can send money to you without the guy in the middle facilitating the transaction and taking an unfairly large chunk of the money

- I have complete control over my money, with no restrictions from anyone else on how and where I choose to use what is mine

- I can send my money very quickly and at a fair cost over the internet

That sounds great, but surely there are some downsides?

No system is perfect. There are many trade-offs that need to be made and some of the most important downsides include:

- Payments vs Store of Value. To facilitate payments, we need something fast. But speed in cryptography comes at the expense of security. Therefore, if you want something done quickly, you may not necessarily have properly secured the transaction. Bitcoin for example cannot compete with the scale of Visa for transaction processing right now. The Bitcoin development community is more concerned about security than speed. Faster transaction speed is a work in progress right now.

- There are still some centralised entities. You acquire bitcoin and other cryptocurrencies through exchanges, which are companies that are run by a centralised team. These guys have the power to act badly and we have evidence fair reason to believe that they have been acting badly

- This is all still really new and really hard work. There are few quick fixes in cryptocurrencies. Yet many people who are in this space are also impatient and want to see quick progress. This leads to a lot of hype for “solutions” that aren’t really solutions and ideas that may on the face of it look exciting but are simply scams.

Anyone thinking this way might very well be right and this could all be a big failure, but I’d like to give a few reasons for why I personally don’t think this is going away.

I’m still not convinced. My money works fine and I’m not interested in using a technology that might fail.

Dismissing a technology with strong network effects is foolish:

- The incentives that are at work in Bitcoin have been proven to be strong. For example, there has never been an invalid transaction and validators have spent a fortune on electricity fees to compete to validate transactions

- Some of the strongest technical minds are working on these projects and fundamentally want to see a more decentralised internet ecosystem. A decentralised internet is a more democratic internet and that freedom is important to people who spend a lot of time thinking about how the internet works

- An ecosystem of people that develop, trade, educate and even troll on this subject has been developed. As the interest in these ideas builds, so do new perspectives and new challenges that help to make the system stronger. Criticising aspects of a technology are an important step towards solving how that technology should work, the perfect answers aren’t apparent at the outset.

People are good at inventing new things and bad at predicting how those things will be used. When Thomas Edison invented the phonograph, he provided the world with the opportunity to record and share sound. Edison wrote down what he expected to be the best uses for his invention and top of his list was the ability to play Christian sermons in the evening. The phonograph would go on to be the catalyst for unlocking a world of music and radio, allowing these to become Brookeion-dollar industries. I think the same applies to cryptoassets. We have an entirely new way to build decentralised applications on the internet and while we don’t know how this will all turn out, you can’t unmake the technology, it’s out in the world.

In Conclusion

This space is new, constantly changing and has many personalities that are eccentric, dramatic and have radical views. Finding the reason in the turmoil is difficult in the world of crypto, however I hope that some of the above has sparked your interest to learn more. Above all else, spend the time to verify the information presented to you and draw your own conclusions.

How does this article compare with other news you’ve read about crypto? Let me know in the comments section below.

If you want to learn more

As an introduction, I would suggest the learning portal at Luno:

https://www.luno.com/learn/en/

If you are more interested in the details of how Bitcoin works, this post:

https://medium.com/@tessr/making-money-530d2bb2b8f7

The #1 place for the latest news in the crypto space is twitter. There is a lot of rubbish out there, but a few sound minds include:

@aantonop

@jimmysong

@Naval

@FEhrsam

@NickSzabo4

@VinnyLingham

@adam3us

@peterktodd

@VitalikButerin

And finally, I write on Medium. If you enjoyed this article you can find some of my other writings at:

Gianluca Sacco

INVESTMENT ANALYST

Gianluca is Chartered Accountant by training. He has worked in multiple fields having lectured at a South African university, trained as an auditor at PwC and worked as a management consultant at McKinsey and Company. Currently he works as an investment analyst in Cape Town, South Africa. He has an interest in incentive structures and technology, which are both central to how cryptocurrencies function.

The expressions or opinions in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that any techniques or strategies discussed are suitable for all individuals or will yield positive outcomes.